The 7-Minute Rule for Frost Pllc

Table of ContentsAn Unbiased View of Frost PllcNot known Factual Statements About Frost Pllc The Main Principles Of Frost Pllc How Frost Pllc can Save You Time, Stress, and Money.Our Frost Pllc PDFs

Bear in mind that Certified public accountants and bookkeeping companies collaborate with their clients to boost financial practices and guarantee responsibility. In this feeling, they are responsible to the public in addition to to their clients. CPAs and auditing firms, as licensed specialists with their very own professional codes of conduct and regulations, are billed with continuing to be independent and objective, no matter of the degree of monetary evaluation they offer to the nonprofit client.

Freedom RequirementAudit company maintains stringent self-reliance from the client to make sure neutral audit results. Freedom is not a stringent commitment. It permits for closer functioning connections with clients. Audit StandardsAudit firm have to follow International Requirements on Auditing (ISA) as well as local bookkeeping criteria. Audit company comply with basic accounting concepts and regional guidelines.

A Biased View of Frost Pllc

Accountancy firms are subject to basic accounting principles with less regulatory examination. If you desire to prepare financial statements without the requirement for an independent audit viewpoint, you need to go for accounting firm.

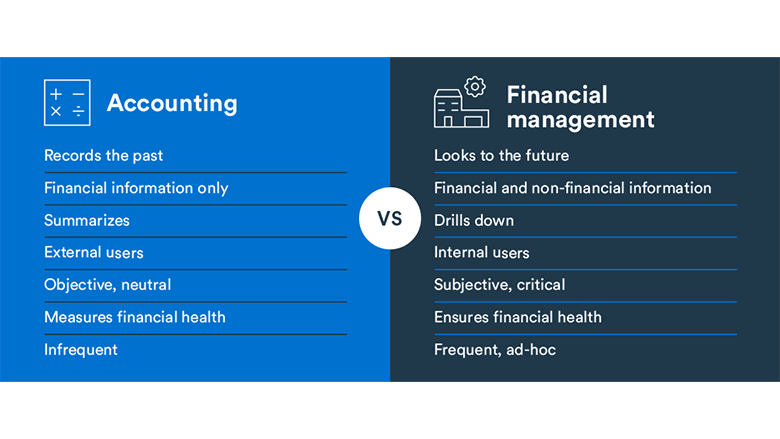

Accountancy and auditing are fundamental in the financial tasks and documents of a firm. Accounting professionals are in fee of developing financial documents, observing regular bookkeeping operations for a firm's procedures, and making and filing tax kinds.

They might concentrate on inner or outside audits (Frost PLLC). it is very important to note that every financial auditor is an accounting professional, but not every accountant is an economic auditor

Public accounting professionals work in companies selling accounting solutions, while business CPAs function at firms marketing something apart from accounting services. Company accountants may start out with greater pay, though the chances for promotion can be leaner. In an accounting company, on the other hand, development can be quick and there's always the potential to come to be a manager or companion.

Little Known Questions About Frost Pllc.

Many recent graduates choose to start with an accountancy firm to develop a structure for later work in the business round. Public accountancy has the benefit of providing a breadth of expertise, nonetheless, work-life balance can be a beast during tax obligation period. Helping an accounting firm will see even more variation in hours.

In corporate bookkeeping, you are making the companyhelping construct its future. In public audit, you just obtain a look right into a firm but play no energetic duty in where it's headed.

The accounting professional might generate additional reports for unique objectives, such as establishing the profit on sale of an item, or the profits created from a particular sales region. These are typically thought about to be managerial reports, instead of the financial records released to outsiders. An instance of a managerial report appears in the adhering to display, which shows a flash report that itemizes the vital functional and accountancy problems of a company.

C firms usually just referred to as companies are public companies that are legitimately my response separate from their proprietors in such a way that is various from any various other type of company (Frost PLLC). Whens it comes to LLCs and minimal liability collaborations, owners are different for the purposes of obligations, however not for revenues and losses

Frost Pllc Can Be Fun For Anyone

Corporations also pay taxes in a different way than other types of firms. For other company see this site frameworks, the proprietor can deal with the service earnings as personal earnings for earnings taxes.

A company, on the various other hand, have to pay tax obligations on its revenues before it can disperse them to the owners. It'll have to pay the 2020 business tax rate of 21% on those revenues, leaving it with $395,000 after tax obligations.

Some companies, if they satisfy particular requirements, could select to operate as S firms. This arrangement permits them to stay clear of dual taxation. Rather than paying company tax obligations, the owners of the corporation pay tax obligations on the business's profits via personal revenue taxes.

The Basic Principles Of Frost Pllc

From high-income tax obligation preparing companies to property tax firms, whatever you are seeking, there is a certain audit firm for it. These firms do audits of business, companies, small organizations, federal government entities, and individuals. Essentially, these firms will always have some business. These companies are needed to conduct annual audits in the majority of places.

Simply like the other types of accounting companies, audit companies can be damaged down additionally in specialized firms. Tiny niche-based companies More Info like this are an excellent means to obtain the most extremely trained accountants for a certain work.